More than 8 million workers will get a raise on New Year’s Day: 23 states and D.C. will see minimum wage hikes ranging from $0.23 to $1.50 an hour

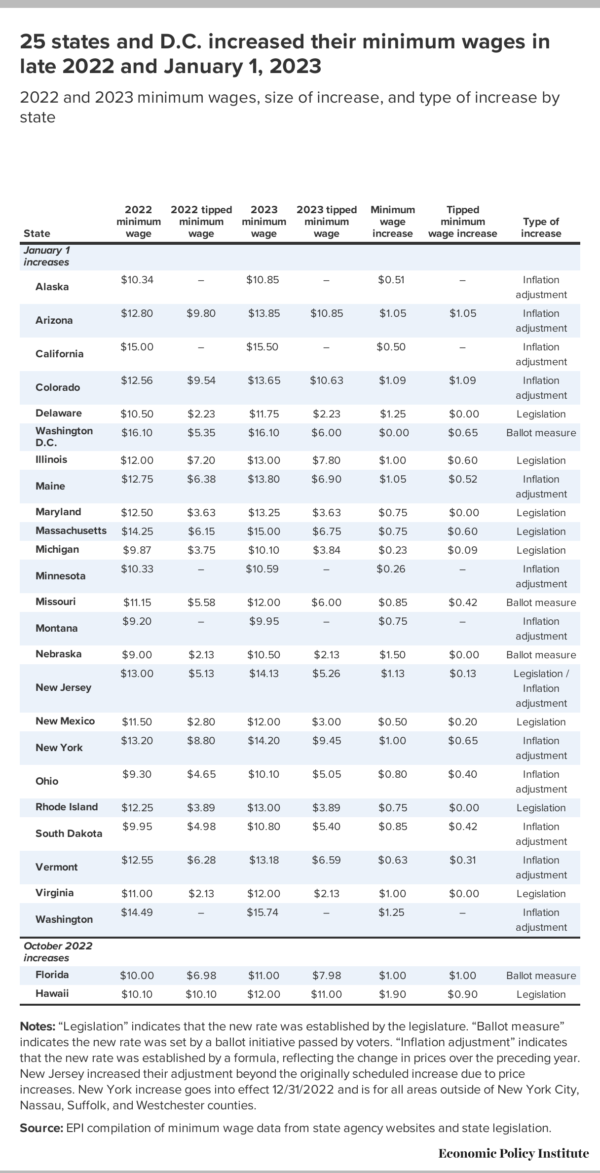

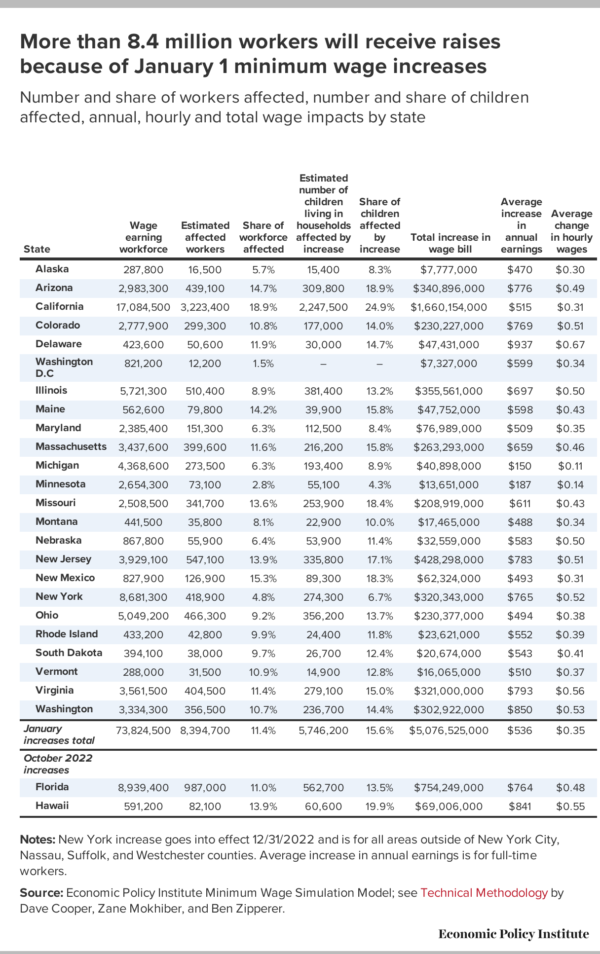

On January 1, 23 states and Washington, D.C. will increase their minimum wages, raising pay for an estimated 8.4 million workers across the country.1 In total, workers’ wages will increase by more than $5 billion, with average annual raises for affected full-time workers ranging from $150 in Michigan to $937 in Delaware. In addition, 27 cities and counties will increase their minimum wages on January 1, adding to the number of workers likely to see increased earnings.

The state with the stingiest increase is Michigan with a 23-cent raise bringing the total to $10.10 an hour, while the biggest hike of $1.50 an hour is in Nebraska, raising the rate to $10.50 an hour.2 Washington, D.C. will not increase its regular minimum wage, but will increase its tipped minimum wage by 65 cents to $6.00 an hour as a result of a ballot measure to eliminate the tipped minimum wage by 2027. When the New Year’s celebrations die down, Washington will be the state with the highest minimum wage of $15.74 an hour.

These increases—including those prompted by automatic inflation-linked adjustments, state law triggers, and legislative action—will benefit workers nationwide, from rural states such as South Dakota to coastal urban states like New Jersey. Most of the affected workers (54.9%) are age 25 or older, and nearly half (44.8%) work full time. Although workers with only a high school degree or less education are the group most likely to be affected, 40.9% of affected workers have at least some college experience. Importantly, more than 2 million parents will get a raise, including more than a million single parents. In total, we estimate that more than 5.7 million children live in households that will see an increase in earnings at the start of the new year.

EPI has long documented the importance of the minimum wage and how it can reduce economic inequality. Because of long-standing discrimination and occupational segregation, women and workers of color make up the majority of low-wage U.S. workers. Consequently, it is not surprising that the majority (58.7%) of workers affected by these minimum wage hikes are women, and workers of color are affected at disproportionate rates as well. The most concentrated impacts are among Hispanic workers (21.8% affected), Black workers (12.2%), and multiracial and Native American workers (14.4%)—groups that make up 20.1%, 9.5%, and 2.0% of the overall workforce in the affected states, respectively. These increases will also have a meaningful impact for workers struggling to make ends meet: 23.2% of affected workers have incomes below the poverty line, while another 26.5% have incomes below twice the poverty line.

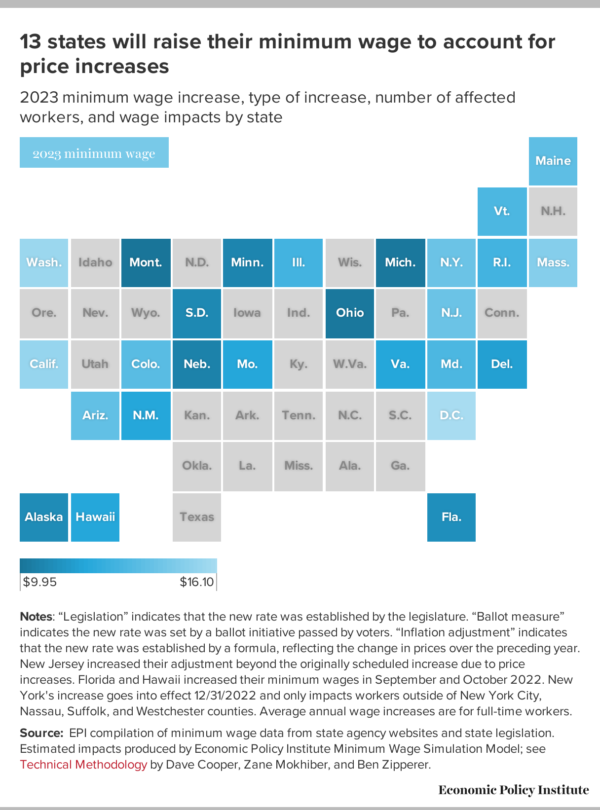

The impact of these minimum wage hikes varies considerably by state and the size of the increase. As Figure A and Table 1 show, some of these increases are the result of automatic inflation-linked adjustments (or “indexing”) that many states have built into their minimum wage laws, helping ensure paychecks keep up with rising prices. Other increases are the result of minimum wage levels set explicitly in state law or through ballot amendments to state constitutions.

Table 2 shows that the greatest number of impacted workers is in California, where 3.2 million workers will see raises—or 18.9% of the workforce.3 The table also shows Florida’s and Hawaii’s minimum wage increases in October 2022, which affected 987,000 and 82,100 workers, respectively.4 For a state-by-state analysis of the workers affected by the January 1 state increases, as well as the October 2022 increases in Florida and Hawaii, download this workbook. These estimates do not account for changes in local minimum wage laws (except New York where minimum wages by region are specified under state minimum wage law), meaning that the total effect of minimum wage increases on January 1 is likely greater.

The annual inflation adjustments in Washington state ($15.74) and a legislative change in Massachusetts ($15.00) will put both states’ minimum wages at or above $15.00 an hour. They join California, Washington, D.C, and the NYC and suburban regions of New York as states with minimum wages at or above that threshold. Ten more states (Hawaii, Florida, Illinois, Nebraska, New Jersey, Connecticut, Delaware, Maryland, Virginia, and Rhode Island) are scheduled to reach $15 an hour or more by 2026. However, there are still more than 22 million workers who earn less than $15 an hour.

Thirteen states (AK, AZ, CA, CO, ME, MN, MT, NJ, NY, OH, SD, VT, and WA) will experience increases because their state minimum wage laws require an automatic minimum wage adjustment to reflect changes in prices from the previous year. New Jersey’s minimum wage was scheduled to rise from $13 to $14 at the start of the year, but since it is indexed to inflation, the state minimum wage will be raised to $14.13 on January 1. In upstate New York, the minimum wage adjustment will not only reflect price increases, but account for growth in labor productivity in the previous year.

Because of high inflation in recent years, these indexed adjustments are greater than they have been historically, but they are still similar in size to other scheduled minimum wage increases from legislation and ballot measures. In states raising the minimum wage because of price indexing, the annual adjustment increases range from $0.26 an hour in Minnesota to $1.25 an hour in Washington, with an average increase across states of $0.84 an hour. In total, more than 6 million workers (71.8% of the total) will get a raise on January 1 because their state makes annual inflation adjustments to the minimum wage.

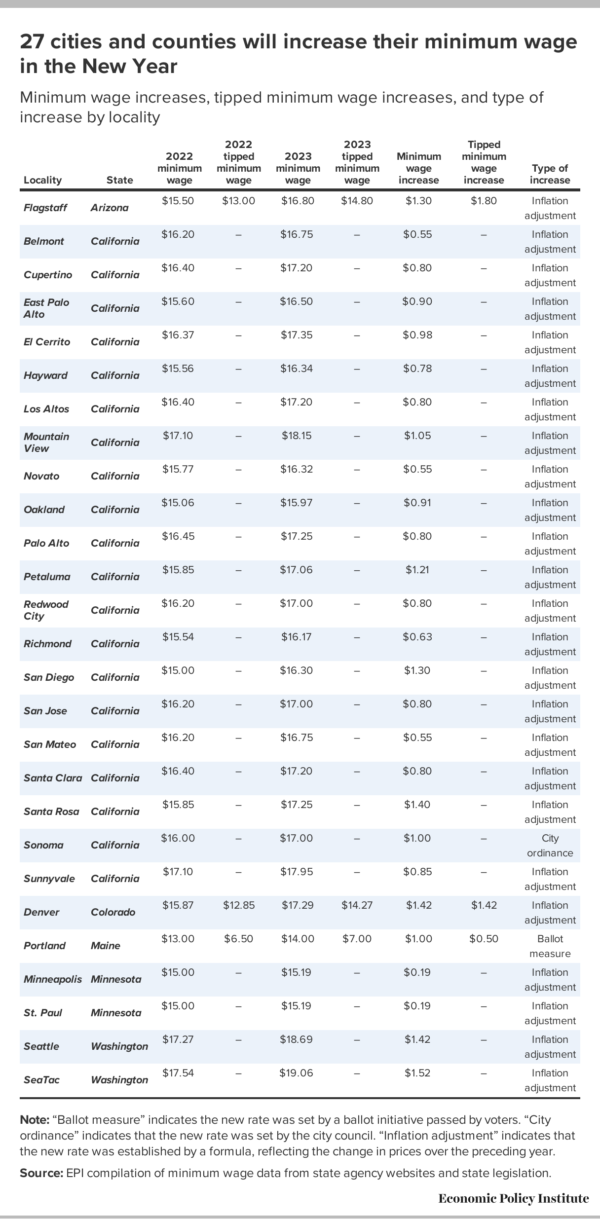

In addition to state increases, Table 3 shows that 27 localities are increasing their minimum wages on January 1. Increases range from $0.19 an hour in Minneapolis and St. Paul (MN) to $1.52 an hour in SeaTac, WA, which has the highest minimum wage in the nation at $19.06 an hour.5 Of the 27 localities with increases this January, 25 will adjust their minimum wage automatically for price changes, while Sonoma, California and Portland, Maine make changes specified by city ordinance and a ballot measure, respectively.

In total, 30 states, D.C., and 46 localities have higher minimum wages than the federal minimum wage of $7.25. This does not include localities that have democratically elected to increase their minimum wage, but found themselves preempted by state legislators, meaning state lawmakers can block local ordinances from taking effect—or dismantle an existing ordinance. Although these states and localities have taken action to protect the economic stability of their lowest-paid workers, federal action is still needed to raise the standards for all low-wage work. This past summer, the purchasing power of the federal minimum wage reached its lowest level in 66 years, a sobering statistic which will continue to worsen as long as the federal minimum wage sits at its current level.

Notes

1. Includes New York where the minimum wage increase goes into effect 12/31/2022. This does not include Hawaii and Florida, which raised their minimum wages in October 2022.

2. Michigan is scheduled to increase its minimum wage again in February to $13.03 after a court ruling found the current minimum wage legislation is unconstitutional for watering down the intended effect of a ballot initiative in 2018.

3. This does not account for CA cities and counties increasing the minimum wage January 1, likely meaning the total effect is greater.

4. Florida’s minimum wage increase went into effect 9/30/2022.

5. The January adjustments in Minneapolis, MN and St. Paul, MN reflect price change from July 2022, the time of the most recent increase.

Enjoyed this post?

Sign up for EPI's newsletter so you never miss our research and insights on ways to make the economy work better for everyone.